The Magic of the Managed Fund

Let’s talk about shares for a minute. No matter how you invest, there are really just two ways to make money from owning shares.

Let’s talk about shares for a minute. No matter how you invest, there are really just two ways to make money from owning shares.

Imagine trying to get fit. You could chase every new diet or workout trend, or you could follow a proven plan. The same goes for investing.

Have you recently used your KiwiSaver to purchase your first home? Perhaps you prudently moved your KiwiSaver to a balanced or conservative fund before withdrawal to minimise market volatility. But what happens after settlement day? For many Kiwis, KiwiSaver becomes a forgotten investment, potentially costing them hundreds of thousands of dollars in retirement savings.

Many firms set high minimum asset requirements – often $500,000 or more – before they’ll even consider taking on a client. We’ve taken a different approach. Here’s why.

For most business owners, their company represents the cornerstone of their financial future. Yet many postpone exit planning until it’s nearly time to sell. As a wealth adviser who’s guided numerous business owners through this process, I’ve seen firsthand how early preparation can dramatically impact both the sale price and the smoothness of the transition.

When clients tell me they plan to move to New Zealand, our conversation quickly moves beyond visa requirements to the complex financial implications of international relocation. At Cambridge Partners, we’ve seen firsthand how financial challenges can significantly impact how successfully people transition from living overseas to settling in Aotearoa.

Moving to a new country is a significant life change that requires careful planning, particularly regarding your finances. At Cambridge Partners, we’ve helped numerous clients successfully navigate the financial aspects of immigrating to New Zealand, especially those applying for parent retirement visas and temporary retirement visas. Our comprehensive approach ensures that your transition to New Zealand isn’t just successful from an immigration perspective but also provides you with financial peace of mind.

As a wealth management professional, I’ve observed that most people approach financial planning with a focus on immediate numbers – how much they earn, how much they can save, or what returns they might get.

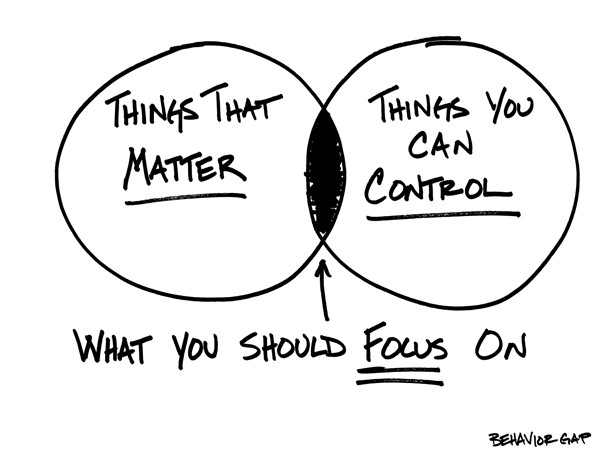

Investing can sometimes feel like a black hole — absorbing as much time and energy as you allow. As one

In a recent financial education workshop for the Wāhine in Property Collective led by Cambridge Partners’ team of Hannah Meikle,

As a financial adviser, I regularly work with clients who are either saving towards retirement or are already retired and

Recent fears of a US economic downturn have sent ripples through global financial markets. What was celebrated as the “Trump

As a financial adviser who has worked with many American expats planning their retirement in New Zealand, I’ve witnessed firsthand

In celebration of International Women’s Day, Cambridge Partners recently hosted an insightful panel discussion focused on women’s financial planning and

Guest Article by Dr Steve Garth, Principiaic.com.au With the US set to impose 25% tariffs on goods from Canada and

Different investment professionals have different opinions or philosophies on how markets work and, as such, how people should invest. At

The New Zealand government has recently announced plans to adjust migrant investor visa categories, with the goal of attracting more

The term “fiduciary” might not be commonly used in New Zealand in the world of financial advice, but its principles

The beginning of the year is always a good time to reflect on financial decisions and lessons learned. While it’s

Smart Investment Strategies for US Expats in New Zealand Living abroad brings exciting opportunities, but for US expats in New

A question people often ask themselves when considering investing is: should we concentrate our investments in potentially high-reward opportunities or

When people think about financial advice, technical expertise often comes to mind first. However, after working with countless clients, I’ve

In the next 10 to 20 years, we’re going to see a massive shift of assets from one generation to

By Financial Adviser Hannah Meikle and Andrew Nuttall In our experience working with legal professionals over the years, we’ve noticed

“The only function of economic forecasting is to make astrology look respectable.” – John Kenneth Galbraith In the history of share

Many United States (‘US’) expats discover soon after leaving the US that US-based financial institutions will restrict access to investment

On 31 July 2024 the changes to the New Zealand personal income tax bands announced in the budget came into

KiwiSaver* is a voluntary work-based savings scheme, introduced to help New Zealanders save for retirement. The aim of KiwiSaver is

by Dominic Sheehan, Financial Adviser and Head of Advice In 2005, Peter Christman and Richard Jackim, wrote a book called

It was 1942, and America was still reeling from the attack on Pearl Harbour. They had also recently entered the

At Cambridge Partners, we refer to our advisers as ‘financial advisers’, whereas the more common term in New Zealand is

Exponential growth is hard to visualise because our brains are not wired to process growth beyond linear projections. The best

The most common piece of feedback we get from new clients is that they wish they had come and seen

‘Beyond returns, a good investing experience depends on how you feel on the journey – just like in life.’ David Booth.

By Hannah Meikle, Financial Adviser at Cambridge Partners The decision to move yourself or another family member into aged care

Fee-only financial advice focuses on integrity and putting the client first. Our advisers don’t get paid commission by companies to

by Hannah Meikle, Financial Adviser at Cambridge Partners KiwiSaver is a voluntary retirement savings scheme in New Zealand, and thanks

Recently, we mourned the passing of a man who almost single-handedly helped us make our clients better investors. Professor Daniel

Modern Portfolio Theory, as recognised by the 1990 Nobel Memorial Prize in Economic Sciences given to Drs Harry Markowitz and

AI is not new, but the effect that Generative AI and Large Language Models have had on the world in the last few years has been nothing short of revolutionary. Entire industries have been transformed overnight, and the breakneck pace of development shows no signs of slowing down – if anything, it seems to be increasing as the AI arms race ramps up.

Can artificial intelligence help pick stocks? More specifically, can investors use AI to determine the fair price of a stock or a bond? I bet a lot of people right now would say yes, given recent advances that allow for the processing of ever greater amounts of information.

I think my AI is better than all the other ones out there. My AI is the market.

The pressure is on. AI is a key strategic objective for businesses across every sector in New Zealand. Leaders are working at pace to understand the potential opportunities and risks, to make the most of this remarkable new tech.

International Women’s Day is an occasion to celebrate the various achievements of women and stands as a call to action for advancing women’s equality. While discussions surrounding the gender wage gap are commonplace, the gender wealth gap is a significant but often overlooked issue.

Towards the end of the calendar year, there’s a natural tendency in the financial media to look both back and

Retirement planning is core to what we do. Providing clarity to our clients through a robust Financial Plan that is

By Michael Youngman, Financial Adviser, Cambridge Partners Determining the right time to retire is difficult as there is no one-size-fits-all

Investing in the share market can often feel like a rollercoaster ride, especially when new transformative technologies emerge, and artificial

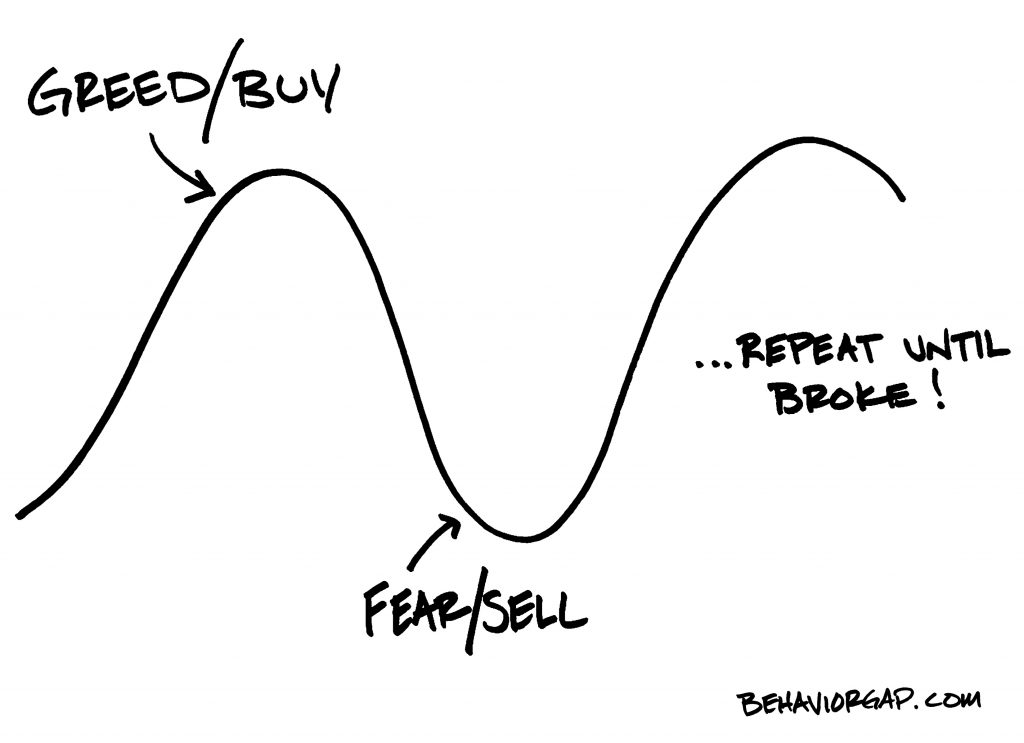

When investing, it is easy to be lured by false promises of beating the market, timing the market, and getting

At Cambridge Partners, we don’t invest based on hunches or gut-feels. Our investment philosophy is based on academic evidence-based research

Last semester, I completed a finance paper, where I studied Dr Harry Markowitz’s Modern Portfolio Theory. His formula and studies

On 19 June 2023 the ASB released their Term Deposit Report (ASB, 2023) highlighting that term deposit rates for June 2023

The risk with insurance policies is that people see it as a ‘set and forget’ arrangement and can cause headaches

Paul Choi is a Financial Adviser with Cambridge Partners. Before joining our team, he worked as a banking adviser for

It’s the time of year when KiwiSaver providers are delivering their Annual Member Statements. This is a great time to

Investing for financial gain and doing good do not have to be mutually exclusive concepts. We offer investors a range

Our consultative wealth management process is designed to set your entire financial house in order and to keep it that

If you’ve had these thoughts, you are not alone. The sudden movement of interest rates is having an impact on

Recently, two US banks failed. Silicon Valley Bank and Signature Bank. Silicon Valley Bank was the bank of choice for

As Financial Advisers, a common question we are asked, given the current market volatility and high inflation, is whether they

Lionel Messi coolly placed the ball on the penalty spot. He had every reason to be confident at that moment.

Countless financial books promise to make you a more intelligent investor, an expert budgeter, or a money guru. But which

David Booth, Executive Chairman and Founder of Dimensional Fund Advisors, discusses choosing the right Financial Adviser. With more than 10,000

Australians and New Zealanders increasingly are interested in how they can make their investment decisions accord with their views about

By Isabelle Williams Senior Investment Strategist and Vice President | Marilyn Giselle Hazlett Analyst, Dimensional Fund Advisors Sustainability goes beyond reducing, reusing, and recycling.

The pandemic showed the power of a previously unknown virus to spread through the global population, threatening health and creating

Investing comes with risk. It’s not necessarily a bad thing, but you need to understand the risk levels associated with

Financial markets have been causing stress for investors, and the emotional toll can lead to poor decision-making. So, what can

Bond markets have experienced a poor start to the year, with interest rates in many countries increasing and projected rate

In this article, Cambridge Partners’ Financial Adviser, Scott Rainey explains what a Bear Market means, how long Bear Markets may

As Financial Advisers, talking about money is part of our day-to-day operations. Coaching people through times of transition and guiding

How would you feel if you worked hard your whole life, but when it came time to retire, you didn’t

Homophobia, sexism, racism – there have been huge advances in addressing attitudes to various groups over the last few years.

Beyond Term Deposits Many New Zealanders have faced tough times recently with COVID-19, high inflation, and rising interest rates. This

I have been reflecting a lot over the past month, on why some investors are moderately calm during a market

By Pip Kean, Cambridge Partners Principal and Financial Adviser Benjamin Roth was a lawyer in Youngstown, Ohio, when the stock

Many people struggle to actually ‘see’ what they will need to secure the sort of retirement they hope to enjoy.

This fascinating article by New York-based author and financial commentator Carl Richards turns the whole concept of retirement on its

This article was written by one of our Financial Advisers, Andrew Nuttall, and was published in the local Law Society

Your retirement is a time when you can truly live your life in a way that is true to the values

Are you loving – or loathing – the thought of spending lots more time with your partner after retirement?! There’s

All the technical talk about investment and superannuation and asset allocation overlooks a few key principles for everyone – life

Time seems to be of the essence when you retire and what you do with that time now becomes a

When it comes to industries, the investment industry is one of the more male dominated around. Because of this, many

For those that remember the film starring Morgan Freeman and Jack Nicholson “The Bucket List” in 2007, you will be

With the world being fast paced, there are many changes that are occurring constantly that can have us worrying about

When we talk with pre-retirees the majority say that they believe the key to happiness is having enough money to

Men are often said to have more familiarity with financial matters, but there is more than a 90% chance that

"*" indicates required fields

By submitting, you agree to receive occasional email updates from Cambridge Partners. You can unsubscribe at any time.

For more information, please click the ‘Read More’ button. To accept cookies from this site, please click the ‘Agree’ button.