It was 1942, and America was still reeling from the attack on Pearl Harbour. They had also recently entered the war in Europe, where the Nazis had reached the height of their power. The future looked decidedly bleak.

Nevertheless, an optimistic young boy of 11, with a habit of looking at the financial pages, took the money he had saved from doing odd jobs like shovelling snow, $114.75 in total, and invested it. In what? A natural gas company called Cities Service which no longer exists today.

That boy was Warren Buffett, who now, at age 93, has a net worth of $136 billion.

We may conclude, rightly enough, that we’ll never be Warren Buffett. We could never match his investing aptitude or success. But to dismiss this outright would mean missing one vital factor that we all share with Buffett that has played a much bigger part in his success than is generally appreciated.

What’s the vital factor?

Time.

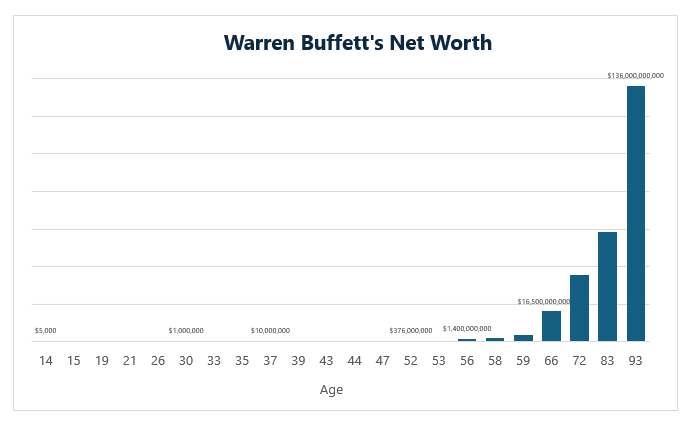

It’s almost impossible to overestimate the importance of time on Warren Buffett’s success in growing wealth. If you need any proof, look at the chart below showing how Buffett’s net worth has changed over time.

Source: https://finmasters.com/warren-buffett-net-worth/

You’ll notice that Buffett’s wealth seems to take off from age 66 onward. By our calculations, approximately 88% of Warren Buffet’s wealth has been generated since he turned 65, the retirement age for many in the United States. Moreover, that number would be 94%1, except for Buffett’s significant philanthropy in recent years.

As evidenced above, time in the market has been incredibly powerful for Buffett, complemented by a fierce determination to own shares starting at age 11.

However, most people would attribute Buffett’s wealth solely to investment prowess. It’s easy to understand why. Before age 65 the average return of Buffett’s business, Berkshire Hathaway, was a little over 34% a year, which is truly remarkable. By contrast, his returns since turning 65 have only been 12% a year.

Yet Buffett has earned 88% of his wealth since age 65 even while his average yearly returns have been much lower. How is that possible?

Time and the miracle of compound wealth.

You see, those 34% per annum returns were on a much smaller asset base. For example, a 34% return on $10,000 will increase your wealth by an additional $3,400. A 12% return on $1,000,000 will increase your wealth by an additional $120,000.

By the time Buffett turned 65, he was earning lower returns but on a much larger base of wealth.

Whilst you may consider this interesting, perhaps you think you have to be Buffett to get a stunning lifetime return on your portfolio. Well, Buffett himself disagrees. In a 2018 interview with Yahoo Finance, he shared this,

“If I put that $114 into the S&P 500 at that time, and reinvested the dividends, think of a figure as to what it would be worth today? The answer is about $400,000. So, if I as a little kid had taken that 114 bucks I’d saved shovelling snow or whatever I’d done — $400,000 today. One person’s lifetime. That’s America.”

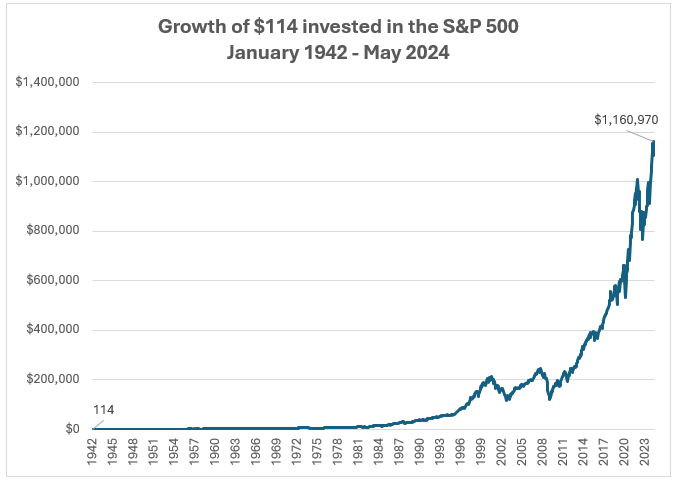

We’ve updated Buffett’s figures to 2024. As of May 2024, his original $114 investment, if it had gone into the S&P 500, would be worth about $1,160,000.

It’s hard to get your head around this, so we’ve detailed what this growth looks like in the chart below. An investment of $114 in the S&P 500, including dividends reinvested from January 1942 until May 2024, grows into over $1,000,000.

The line on the chart looks like it barely moves from the 1940s to the 1990s but then goes up sharply over the last 30 years. In that way, it isn’t dissimilar to the growth of Buffett’s overall wealth.

Warren Buffett wants you to conclude that the miracle of compound growth isn’t merely for the few with the skill, experience and expertise that he has. Anyone can grow wealth as long as they have time and discipline Buffett finished his 2018 interview this way –

“You don’t want to buy to hold for a year, and you don’t want to buy with the idea that you could sell it in two years or three years necessarily and make money. You could lose money that way.”

Whilst we’re perfectly aware that most clients reading this aren’t aged 11 with $114 to invest, you are likely still at an age where the power of markets and compound wealth can help grow substantial wealth.

We hope this article encourages you to maintain optimism, resilience and discipline in your long term plan. But you may also have a younger person in your life you can share this with. For them, this is potentially a lesson in creating true financial independence.

Article provided by Consilium.

[1] Based on the cumulative return of Berkshire Hathaway shares