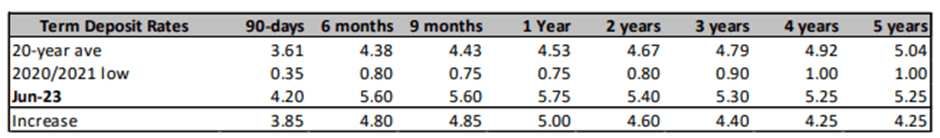

On 19 June 2023 the ASB released their Term Deposit Report (ASB, 2023) highlighting that term deposit rates for June 2023 are above the average experienced in the past 20 years.

ASB Economists expect term deposit rates to settle around the current levels later this year and believe these levels may have peaked (ASB, 2023). While this initially seems like great news, especially with a drop in the annual inflation rate from 6.7% to 6.0% on 19 July 2023, high inflation means that increased living costs are eroding returns.

Table 1. June ASB Term Deposit Rates, including 20-year average and 2020/21 low

Source: ASB Term Deposit Report, ASB 2023.

What is inflation and how does it affect term deposits?

Inflation is the rate at which the general prices for goods and services rise. Inflation erodes the purchasing power of money over time. It also reduces the return on all investments – including term deposits.

As Financial Advisers, we often look at the inflation-adjusted return, also known as the real rate of return or required rate of return. You can see the true earning potential by removing inflation from the return on an investment. A key point to remember is that inflation lowers positive returns and increases the magnitude of losses (Investopedia, 2023).

When will inflation drop?

The Reserve Bank of New Zealand (RBNZ) uses the Official Cash Rate (OCR) to decrease inflation. The RBNZ’s Monetary Policy Committee (Committee) meets seven times a year to review the OCR and, on 12 July 2023, agreed to leave the rate at 5.50%. Interest rate levels are constraining spending and inflation pressure as anticipated and required (RBNZ, 2023). On 19 July 2023, Stats NZ confirmed the annual inflation rate had dropped to 6.0%, after a 32 year high to June 2022. This is a sign that higher interest rates are working to reduce consumer spending. The Committee also indicated that interest rates would remain restrictive, allowing inflation to return within the target range of 1 to 3% per annum.

Risks with term deposits

All investing comes with risk. The level of risk will differ based on the period invested, the level of risk you are comfortable with and the return you are expecting.

Term deposits have historically been a way to generate stable income when inflation is stable and within the target range of 1 to 3%. But in times of high inflation, investors may need to seek alternative ways of achieving their income goals.

To put inflation and term deposits into perspective, here is an example:

- ASB 1-year term deposit 5.75% (based on June 23. See Table 1)

- Minus Inflation 6.0% (current rate)

- Equals Inflation-adjusted return -0.25% (before tax is deducted)

- Result: The return on the investment is not able to keep up with the increase in the cost of goods and services

Term deposits: Things to consider

- Do you need access to your money? Term deposits are a locked-in investment and are generally not accessible until maturity. If the bank agrees to break the term deposit you will not receive the level of interest agreed at outset.

- Are term deposits safe? Ensure your term deposits are held with a trusted and reputable provider. Banks and financial institutions, like ASB, are rated by international credit rating agencies that assess their capability and willingness to repay debts. For more information on credit ratings (RBNZ, 2023).

- Will term deposits be enough? Investing for one year will generally provide a higher return than a shorter period of time, however, rates for longer periods of time may decrease as banks anticipate term deposit rates falling. Decide whether having your money locked in for a period is right for you and what you want to achieve.

- Check that you are paying the correct amount of tax. Resident Withholding Tax (RWT) is based on your taxable income. Be sure you are not paying too much or too little.

Overall, there are significant challenges for term deposits during periods of high inflation. What may have worked in the past, may not work in a high inflation environment. If you have a term deposit and are wondering if it is still suitable for you, talk to a Financial Adviser. They can provide clarity by reviewing your situation and provide investment advice and wealth management to help you achieve your financial goals.

By Jenaia Clarke, Cambridge Partners

21 July 2023

Works Cited

ASB. (2023). Term Deposit Report. https://www.asb.co.nz/content/dam/asb/documents/reports/term-deposits/asb-term-deposit-report-June-2023.pdf.

Investopedia. (2023, July 18). Inflation-Adjusted Return: Definition, Formula, and Example. Retrieved from Investopedia: https://www.investopedia.com/terms/i/inflation_adjusted_return.asp

RBNZ. (2023, July 18). Information on bank credit ratings. Retrieved from Reserve Bank of New Zealand: https://www.rbnz.govt.nz/regulation-and-supervision/oversight-of-banks/standards-and-requirements-for-banks/bank-credit-ratings

RBNZ. (2023, July 18 ). Official Cash Rate remains on hold. Retrieved from Reserve Bank of New Zealand: https://www.rbnz.govt.nz/hub/news/2023/07/official-cash-rate-remains-on-hold