Our consultative wealth management process is designed to set your entire financial house in order and to keep it that way for the rest of your life.

Richard Austin, Co-Founder

Is Your Financial House in Order?

Can you recall the last time you sat down and worked out where you are financially and where you want to be? Are you confident that your personal and financial decisions are aligned with what matters to you most as well as your most important financial goals?

Today’s financial markets offer investors an ever-increasing array of choices and information, but most investors are still searching for clarity and peace of mind that they are on the right track.

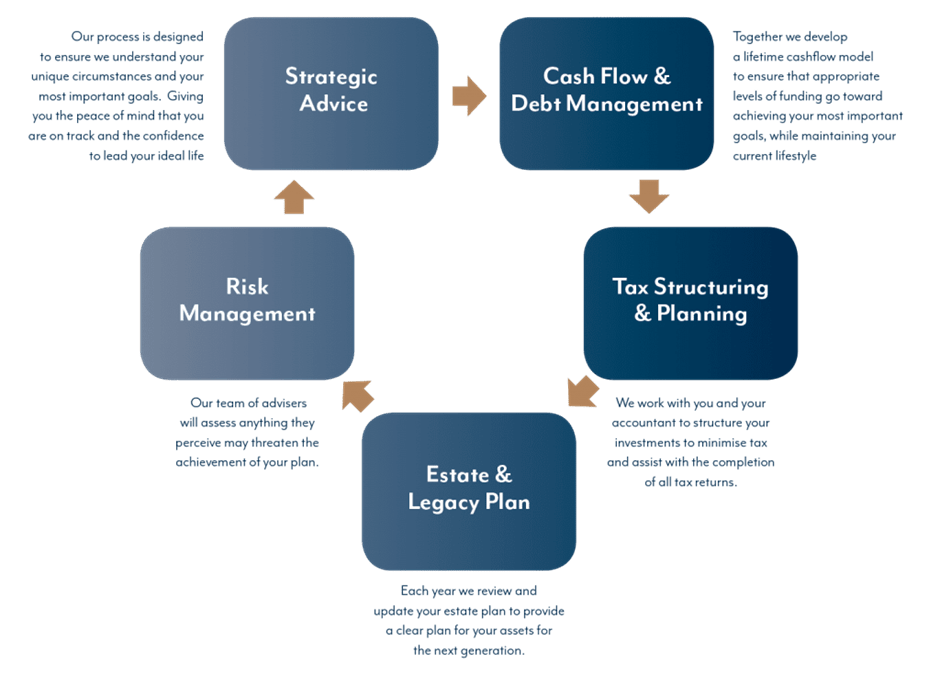

A Simple But Powerful Model

Our comprehensive, integrated approach draws on best practices from a variety of fields, employing a combination of internal and external experts to fulfil the needs of our clients as completely and effectively as possible.

Our process utilises our in-house expertise in the critical areas of investment management and wealth accumulation. We will project manage the engagement of other professionals in the fields of tax, estate planning, philanthropy, and risk management to ensure that we all work to common goals.

Our Ongoing Relationship

Our approach to wealth management is holistic and comprehensive and draws from a team of highly qualified and experienced advisers who are committed to your financial well-being.

Through our ongoing relationship, we make sure we take into account changes in the market or your circumstances.

Our ultimate goal is to provide you with the greatest probability of achieving your goals.

Disclaimer: This article is general information and does not consider your financial situation or goals and does not constitute personalised advice. There are no warranties, expressed or implied, regarding the accuracy or completeness of any information included as part of this article.

Our advice will be in the context of your wider financial affairs and consider the impacts of tax and asset protection. However, we are not lawyers, tax accountants, or personal insurance advisers and therefore, we will not provide specific estate, tax planning, or insurance recommendations or advice. If, during our discussions, we believe that such advice is required, we will be happy to refer you to a suitably qualified adviser.