Exponential growth is hard to visualise because our brains are not wired to process growth beyond linear projections. The best example is to imagine taking 30 steps. You’d probably end up about 30 metres from where you started. But what if those steps were exponential, doubling with each stride? Suddenly, you’re not just across the room; you’re circling the globe 26 times over. This is the essence of compounding, a simple yet profound concept that can transform both your life and your finances.

Compounding is straightforward: it’s interest-earning interest. Invest $100 at a 10% annual return, and you’ll have $110 after a year. The following year, that 10% works on $110, not just the original $100. As years pass, your principal and the interest it generates grow exponentially.

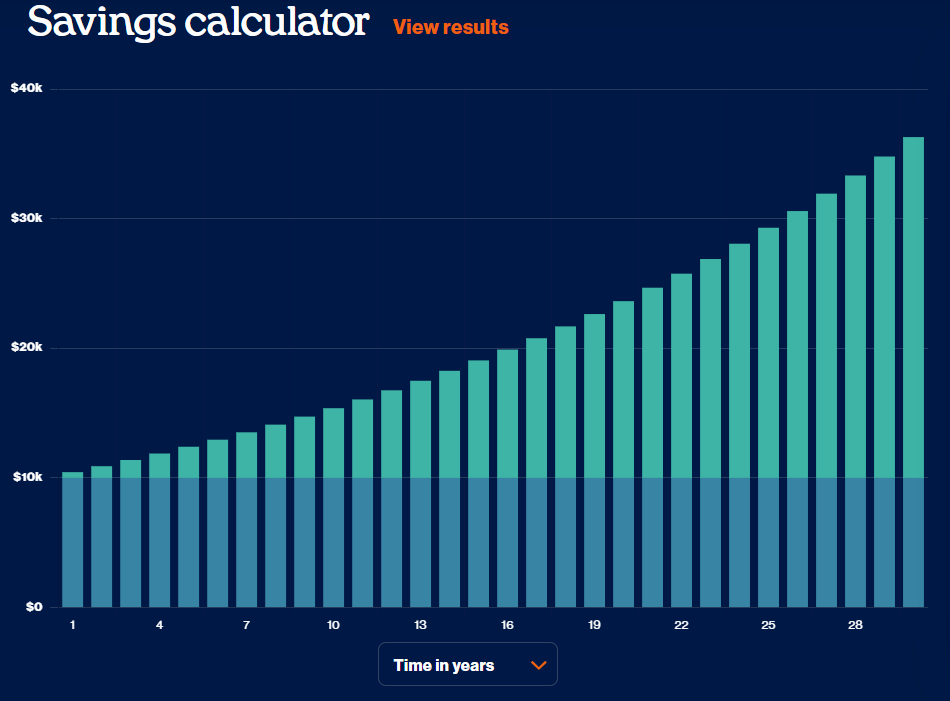

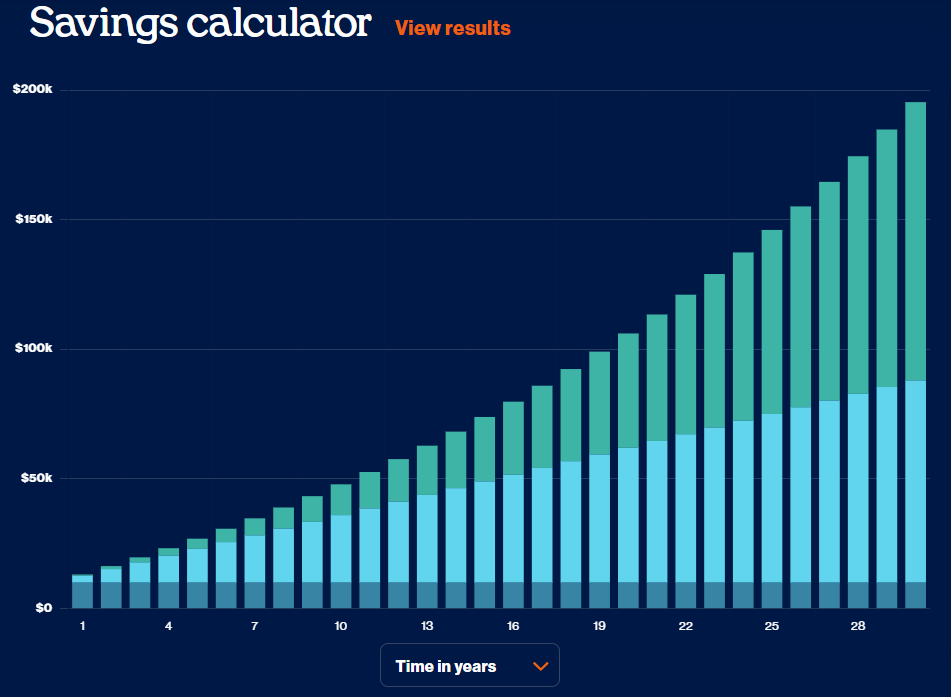

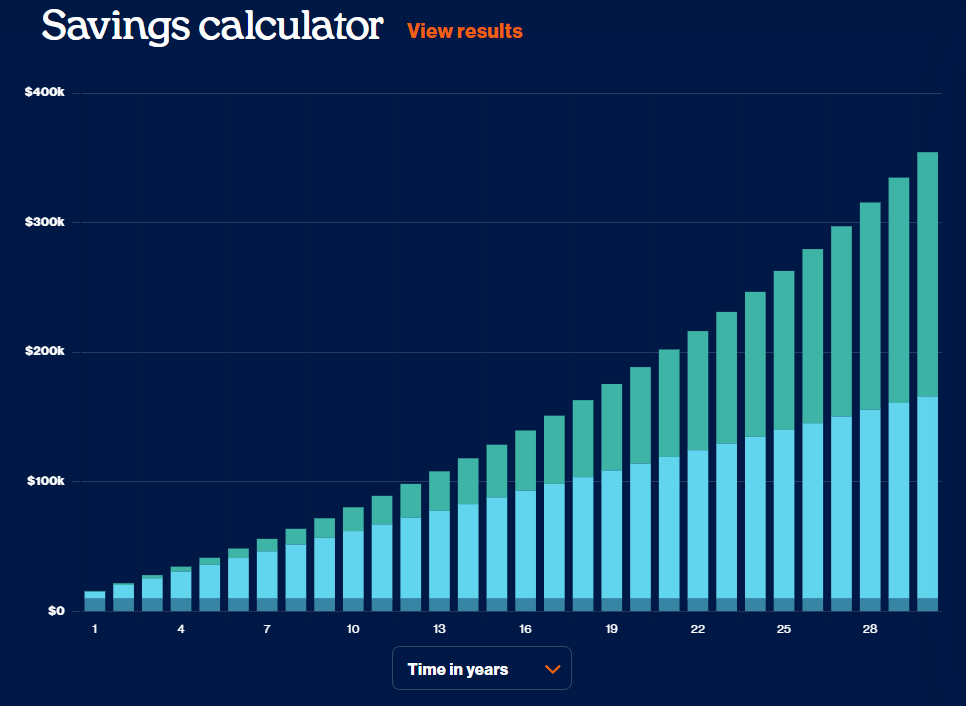

However, the most critical element in compounding isn’t the initial amount or the interest rate — it’s time and savings. Let’s look at an example using Sorted’s Savings Calculator1:

Jane, age 35, invests $10,000 today. Assuming a 7% annual return if she leaves the investment untouched until she retires at age 65, her initial deposit could increase by 3.6 times, to around $36,000.

But what if Jane contributed just $50 per week to her initial balance of $10,000? She’d end up with almost 20 times her initial deposit, around $195,000.

And if she contributed $100 per week? That would increase the initial deposit to around $350,000.

The earlier you start, the more dramatic the compounding effect on your savings and investments. It’s never too late to begin your financial and investment journey, but the best time is always now. Save diligently, invest wisely, and give your assets the time they need to grow.

The principle of compounding applies not just to money but to habits, skills, and relationships. Start small, be consistent, and watch as the compounding effect works its magic in all areas of your life.

At Cambridge Partners, we understand the transformative power of compounding. Our Advisers are ready to help you put in place a plan for your financial future. Contact us today, and let’s start building your wealth, one compounded step at a time.

(1) https://sorted.org.nz/tools/savings-calculator

Disclaimer: This article is general information and does not consider your financial situation or goals and does not constitute personalised advice. There are no warranties, expressed or implied, regarding the accuracy or completeness of any information included as part of this article.