At Cambridge Partners, we follow an evidenced-based approach and design investment portfolios based on academic research. This has led to the development of 10 time-tested investment principles that we employ to improve your odds of success.

Our Investment Principles

1. Embrace market pricing

The market is an effective information-processing machine. Each day, the world equity markets process billions of dollars in trades between buyers and sellers – and the real-time information they bring helps set prices.

2. Don’t try to outguess the market

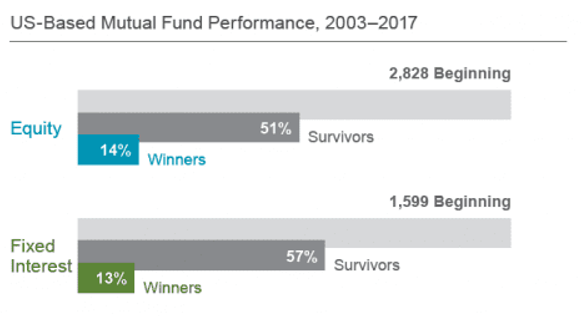

The market’s pricing power works against mutual fund managers who try to outperform through stock picking or market timing. As evidence, only 14% of US equity mutual funds and 13% of US fixed-interest mutual funds have survived and outperformed their benchmarks over the past 15 years.

3. Resist chasing past performance

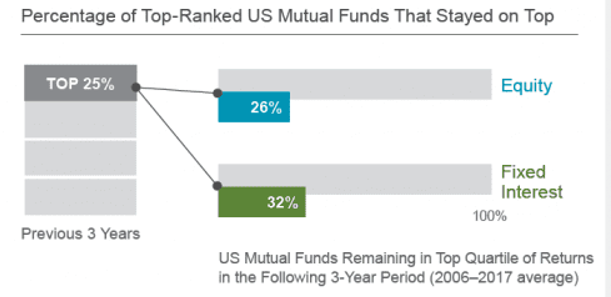

Some investors select mutual funds based on their past returns. Yet, past performance offers little insight into a fund’s future returns. For example, most US mutual funds in the top quartile (25%) of previous three-year returns did not maintain a top-quartile ranking in the following three years.

4. Let markets work for you

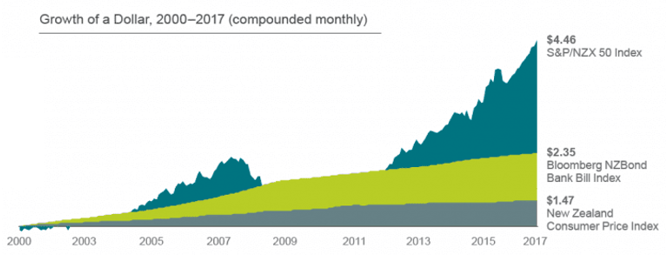

The financial markets have rewarded long-term investors. People expect a positive return on the capital they supply, and historically, the equity and bond markets have provided growth of wealth that has more than offset inflation.

5. Consider the drivers of returns

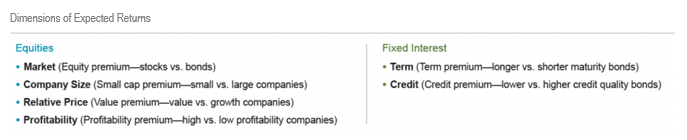

Academic research has identified these equity and fixed interest dimensions, which point to differences in expected returns. Investors can pursue higher expected returns by structuring their portfolio around these dimensions.

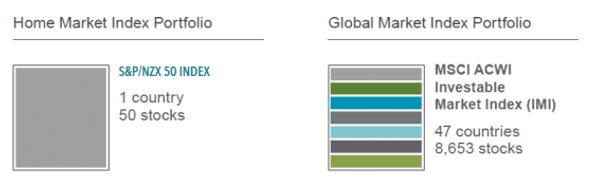

6. Practice smart diversification

Holding securities across many market segments can help manage overall risk. But diversifying within you home market may not be enough. Global diversification can broaden your investment universe.

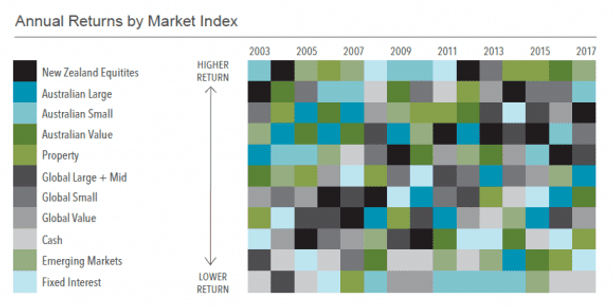

7. Avoid market timing

You never know which market segments will outperform from year to year. By holding a globally diversified portfolio, investors are well positioned to seek returns wherever they occur.

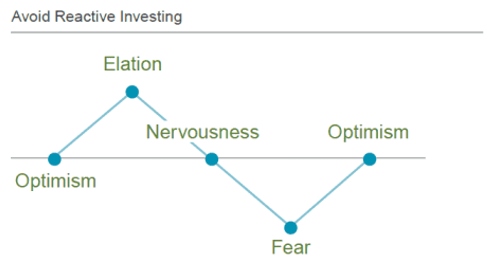

8. Manage your emotions

Many people struggle to separate their emotions from investing. Markets go up and down. Reacting to current market conditions may lead to making poor investment decisions.

9. Look beyond the headlines

Daily market news and commentary can challenge your investment discipline. Some messages stir anxiety about the future, while others tempt you to chase the latest investment fad. When headlines unsettle you, consider the source and maintain a long-term perspective.

10. Focus on what you can control

A Financial Adviser can offer expertise and guidance to help you focus on actions that add value. This can lead to a better investment experience.

- Structure a portfolio along the dimensions of expected returns.

- Create an investment plan to fit your needs and risk tolerance.

- Diversify globally.

- Manage expenses, turnover and taxes.

- Stay disciplined through market dips and swings.

The material presented on this page is provided for information purposes only. The funds referenced in principles 2 and 3 are U.S. mutual funds and are therefore not available to New Zealand investors. Please refer to our investment disclosures page for more information.

Disclaimer: Information as at 5 July 2023. This article is general information and does not consider your financial situation or goals and does not constitute personalised advice. There are no warranties, expressed or implied, regarding the accuracy or completeness of any information included as part of this article.

This material is issued by DFA Australia Limited (incorporated in Australia, AFS License No. 238093, ABN 46 065 937 671). Investors should also consider the Product Disclosure Statement (PDS) and for the Dimensional Wholesale Trusts the target market determination (TMD) that has been made for each financial product or financial advice product either issued or distributed by DFA Australia Limited prior to acquiring or continuing to hold any investment. Go to to access a copy of the PDS or the relevant TMD. Any opinions expressed in this material reflect our judgement at the date of publication and are subject to change.