Modern Portfolio Theory, as recognised by the 1990 Nobel Memorial Prize in Economic Sciences given to Drs Harry Markowitz and William Sharpe, and the Efficient Market Hypothesis, as recognised by the 2013 prize given to Dr Eugene Fama, are the foundations on which the portfolio will be structured and how subsequent decisions will be made. The underlying concepts of this scientific approach to investing are:

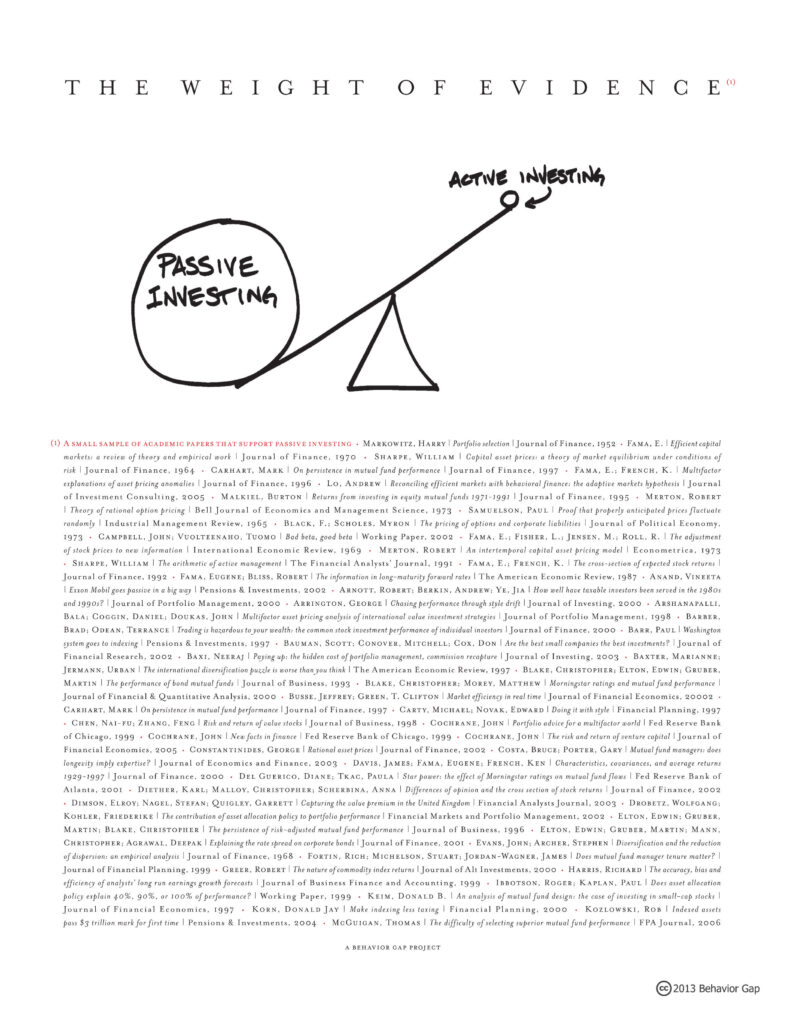

- Market prices reflect all available information – prices adapt quickly to new information and fairly reflect the knowledge and expectations of all investors. Therefore, extensive and expensive securities analysis is unlikely to provide sufficient benefit to consistently justify its cost.

- Diversification reduces unnecessary risks – unsystematic or company-specific risks can be dramatically reduced through appropriate diversification, enabling the portfolio to principally be exposed to market, or systematic risk. Diversification is enhanced by holding the majority of available securities within an asset class and including multiple asset classes (such as international shares and bonds) within the portfolio.

- Investors are risk averse – the only acceptable risk is one that is adequately compensated for by potential portfolio returns. Rational investors will not invest in higher risk assets (eg, shares) if there is no long term potential for them to earn more than investing in bonds or fixed interest.

- The design of the portfolio is paramount – the appropriate allocation of capital among asset classes (shares, bonds, fixed interest, etc) will have a greater influence on long term portfolio returns than the selection of individual securities. Investing for the long term (preferably longer than ten years) is central to investment success because it allows the long term characteristics of asset classes to surface.

Asset class investing incorporates the scientific conclusions of Modern Portfolio Theory, the Efficient Market Hypothesis and a significant body of academic research about the expected returns of investments. This research, led by Professor and Nobel Laureate, Eugene Fama, of the University of Chicago, and Professor Kenneth French, of Dartmouth University, has identified the factors that explain long term differences in share and bond returns that we can reasonably expect to persist into the future. The research demonstrates that the differences are economically sensible, persistent across time, pervasive across markets, robust to alternative specifications and cost effective to capture in well diversified portfolios.

They have found that over 90% of the performance of a diversified equity portfolio can be explained by the following four factors:

- Equity market – shares have higher expected returns than fixed interest

- Company size – small company shares have higher expected returns than large company shares

- Value – relatively low priced ‘value’ company shares have higher expected returns than relatively high priced ‘growth’ company shares

- Direct profits – shares of high profitability companies have higher expected returns than the shares of low profitability companies

Neither picking individual securities, nor timing the purchase or sale of investments in an attempt to ‘beat the market’, are likely to increase long term investment returns, and can significantly increase portfolio costs. Such practices are, therefore, to be avoided.

Asset Class Investing

Using the foundations provided by Modern Portfolio Theory and the Fama-French research, asset class investing aims to construct investment portfolios that reliably deliver the high diversification and the higher expected returns of certain asset classes. An asset class is a group of securities that share common risk and return characteristics, and is typically defined according to:

- Investment type – shares, bonds or property

- Geography – domestic, international or emerging market

- Risk factor – small company, value company, profitability

Asset class portfolios purchase the vast majority of, if not all, the securities within the selected asset class, whilst keeping trading costs and ongoing management expenses as low as possible.

No subjective forecasting of market or economic conditions is involved. Essentially, no attempt is made to distinguish between undervalued and overvalued securities after taking account of the higher expected returns available from the factors mentioned above. Securities are considered for purchase when they meet the asset class parameters defined by the investment mandate; they are considered for sale when they do not.

Process for Selecting Underlying Investments

The single most important factor affecting risk and return in an investment portfolio is the allocation between growth (shares and property) and income (cash and fixed interest) assets.

Once the growth and income allocations have been selected, the portfolio is allocated between the broad asset classes – New Zealand, Australian, international and emerging market equities; listed property; international infrastructure; international and New Zealand fixed interest.