Financial Advice Without the Wealth Barrier

Many firms set high minimum asset requirements – often $500,000 or more – before they’ll even consider taking on a

Many firms set high minimum asset requirements – often $500,000 or more – before they’ll even consider taking on a

For most business owners, their company represents the cornerstone of their financial future. Yet many postpone exit planning until it’s

When clients tell me they plan to move to New Zealand, our conversation quickly moves beyond visa requirements to the

We are excited to be awarded the ‘Canterbury Trusted’ accolade by Business Canterbury. This recognition underscores our ongoing commitment to

At Cambridge Partners, supporting the arts in Christchurch is a cause close to our hearts. The arts showcase the incredible

We are excited to let you know about the latest development in our company’s ownership journey (timely after our recent

Key market movements for the quarter The first quarter of 2025 saw a change in market leadership, with the US

Fresh off the back of an excellent year in 2024, the first three months of 2025 ushered in a more

The underlying performance of global shares was mixed during the October to December quarter. Overall, markets advanced thanks to gains

The risk with insurance policies is that people see it as a ‘set and forget’

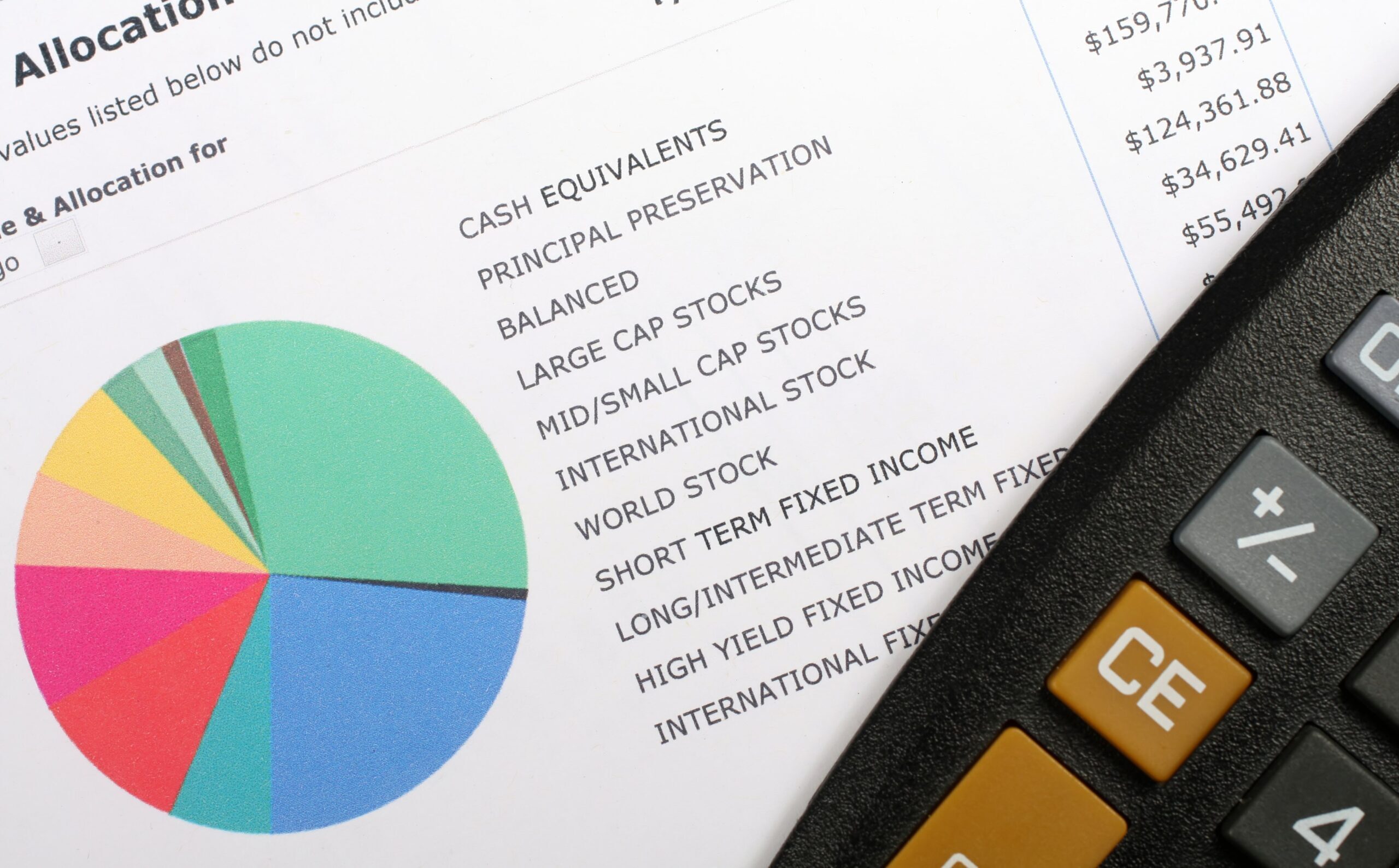

Cambridge Partners constructs investment portfolios for your financial situation, preferences and objectives. We offer a

A professionally developed plan is the best way to ensure your financial, lifestyle, and personal

For more information, please click the ‘Read More’ button. To accept cookies from this site, please click the ‘Agree’ button.