Last semester, I completed a finance paper, where I studied Dr Harry Markowitz’s Modern Portfolio Theory. His formula and studies in the 1950s created the foundation of today’s investment practices. Dr Markowitz passed away this year aged 95, and not only was he the first to treat the art of investing as a science, but his findings became embedded into research that we still use today.

To reduce risk, it is necessary to avoid a portfolio whose securities are all highly correlated with each other. One hundred securities, whose returns rise and fall in near unison, afford little protection than the uncertain return of a single security

Dr Harry Markowitz – Nobel Laureate

At Cambridge Partners we utilise Modern Portfolio Theory with our evidence-based investment approach. This means systematically reviewing, appraising and implementing academic research findings to provide optimal investment solutions.

The fundamentals of our investment approach are:

1. Markets work efficiently:

The market is an effective information processing machine. Each day, the world equity markets process billions of dollars in trades between buyers and sellers – and the real-time information they bring helps set prices.

2. Don’t try to outguess the market:

The market’s pricing power works against mutual fund managers who try to outperform through stock picking, sector picking or market timing. As evidence, 19% of US equity mutual funds and 11% of fixed-income funds have survived and outperformed their benchmarks over the past 20 years. The Financial Markets Authority’s Value for Money Industry Report confirms the blind spots of active fund investors.

3. Resist chasing past performance:

Some investors select mutual funds based on their past returns. Yet, past performance offers little insight into a fund’s future returns.

4. Let the markets work for you:

The financial markets have rewarded long-term investors. People expect a positive return on the capital they supply, and historically, the equity and bond markets have provided growth of wealth that has more than offset inflation.

5. Consider investment dimensions:

Over the past 50 years,capital market research has gained a powerful understanding of the dimensions that generate higher expected returns. Dimensions help us adjust your portfolio’s total expected return profile to build a strategy that minimises risk, maximises returns and achieves your investment goals. For example, Strategic Asset Allocation determines a portfolio’s long term expected risk and return characteristics. Investments should be allocated to a range of assets based on:

- Investment type – for example, shares, fixed income, or property.

- Geography – domestic, international, or Emerging Markets.

- Risk exposure – for example, Profitable, Small, or Value companies.

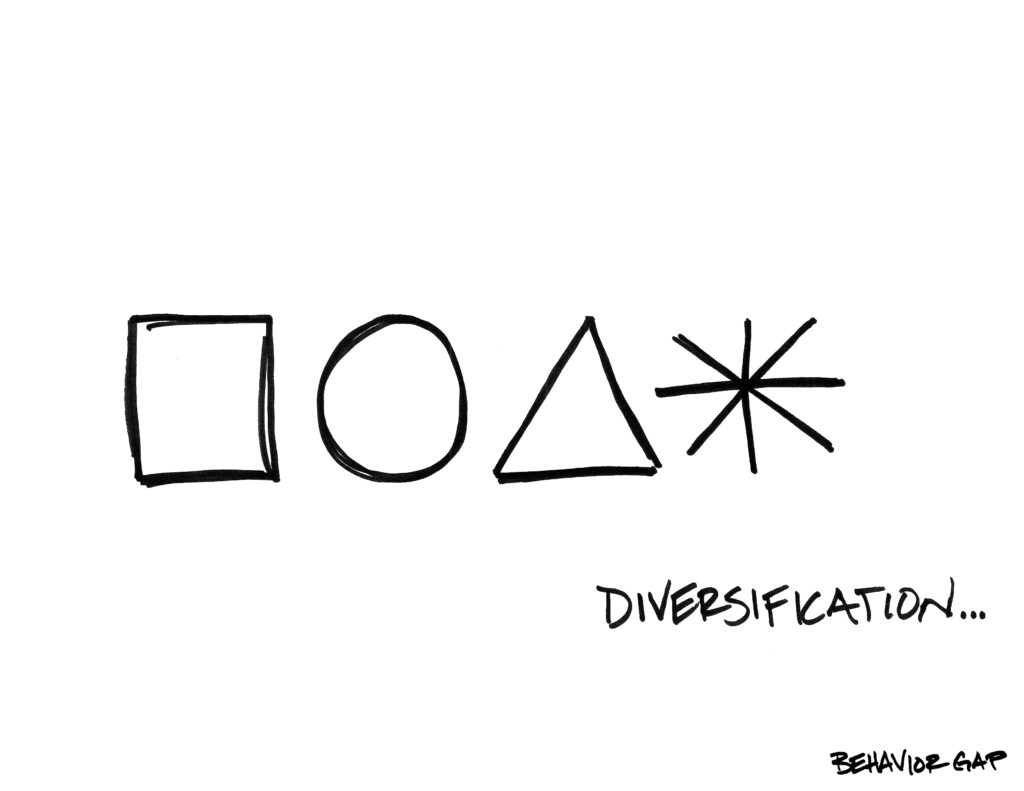

6. Diversification:

Diversification is the most effective countermeasure to manage portfolio risks and enables investors to capture more reliable returns driven by broader economic forces. Holding securities across many asset classes can help manage overall risk. Although diversifying within your home market may not be enough, global diversification can broaden your investment universe.

7. Avoid market timing:

You never know which market segments will outperform from year to year. By holding a globally diversified portfolio, investors are well-positioned to capture returns wherever they occur.

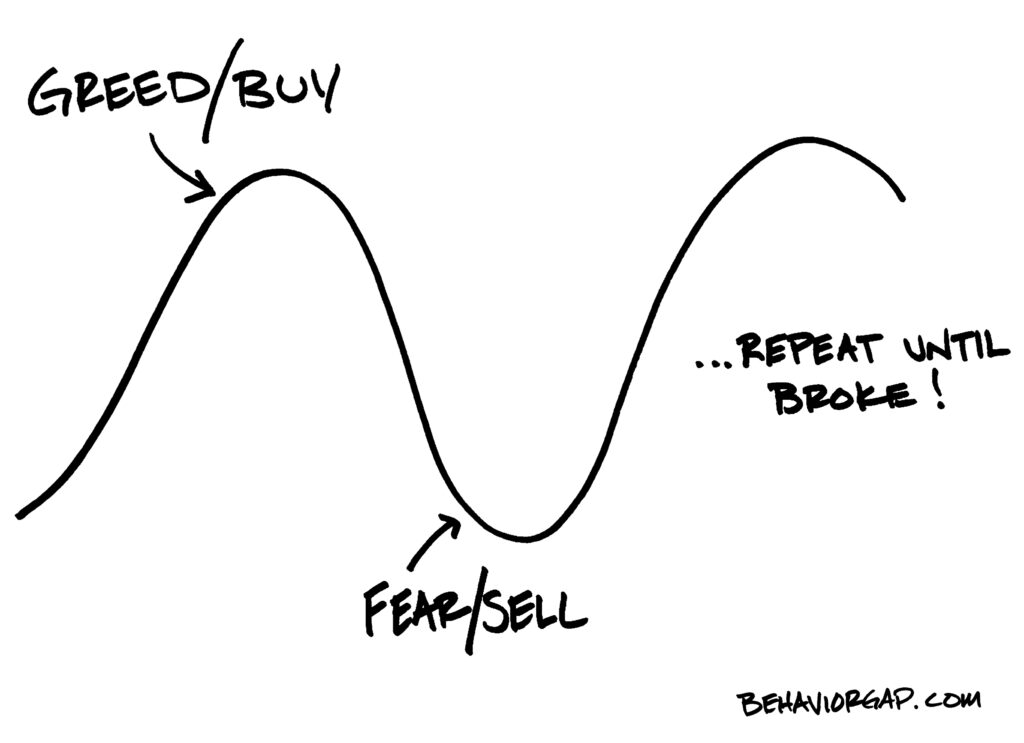

8. Manage your emotions:

Many people struggle to separate their emotions from investing. Markets go up and down. Reacting to current market conditions may lead to making poor investment decisions.

9. Look beyond the headlines:

Daily market news and commentary can challenge your investment discipline. Some messages stir anxiety about the future, while others tempt you to chase the latest investment fad. When headlines unsettle you, consider the source, and maintain a long-term perspective.

10. Focus on what you can control:

When you work with a Financial Adviser at Cambridge Partners, we can create a plan tailored to your personal financial needs, while helping you focus on actions that add value. Reducing fees, taxes, and trading costs can measurably improve the performance of a portfolio without incurring additional risk.

Summary

Dr Harry Markowitz has left an enduring legacy with his Modern Portfolio Theory. His scientific research in investing has provided the framework for our evidence-based approach. Constructing a well-diversified investment portfolio tailored to your risk tolerance, time horizon, and financial objectives increases the likelihood of achieving your goals.

References

Financial Markets Authority. (2022). Value for Money. https://www.fma.govt.nz/assets/Reports/Value-for-Money-Industry-Report.pdf: Financial Markets Authority.

The Behaviour Gap – Carl Richards

Wealth with Purpose – David Andrew

Dimensional Fund Advisers

The Evidenced Based Investor – TEBI