This article was written by one of our Financial Advisers, Andrew Nuttall, and was published in the local Law Society journal ‘Canterbury Tales’.

Recently we presented another financial planning workshop for young lawyers and of interest was a concept illustrated by Carl Richards, one of our colleagues, who writes a weekly column in the New York Times.

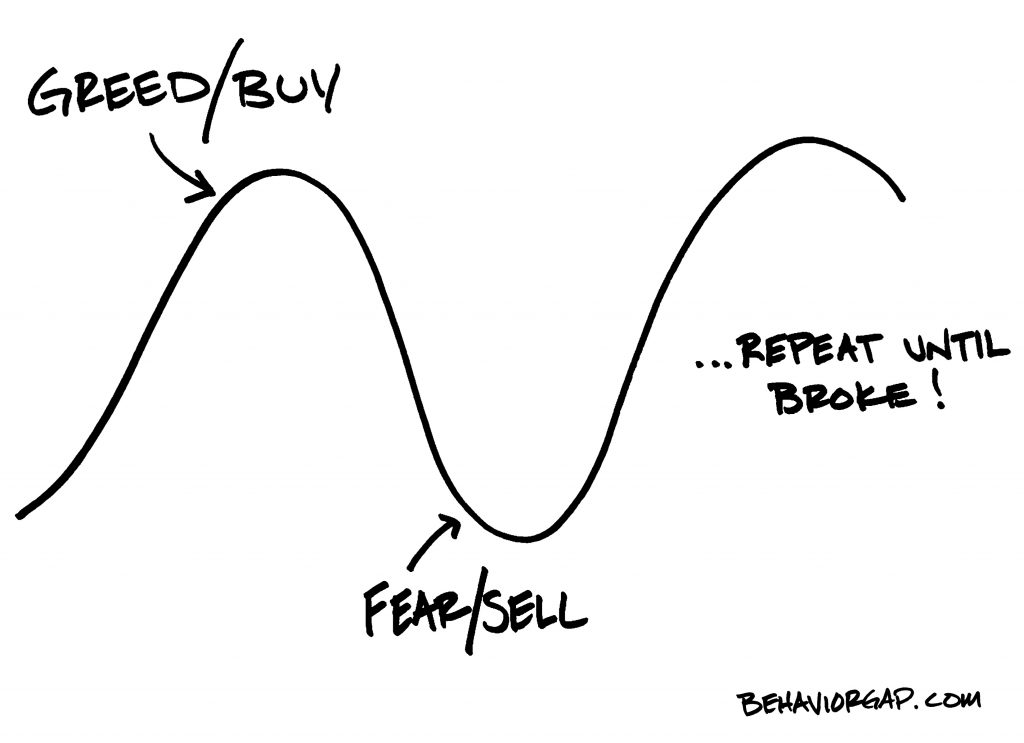

Over the years I have seen how important it is for people to first develop an investment strategy and then maintain it because of the conundrum between fear and greed, risk and return.

Humans have a natural bias towards fear and greed. Sometimes they are great attributes for survival, but they can be a real hindrance when dealing with money and investing. We humans, it seems, are not necessarily hard wired to be good investors.

The media have figured this out and play on it by focussing on bad news. When sharemarkets fall 3% headlines threatening world recession, Global Financial Crisis II and looming economic disaster appear but when markets increase by 3% we don’t read about it. The media loves appeal to our worries and anxieties, chiefly because they know it will sell advertising space sadly better than positive news would.

This playing on our emotions by the media can cause us to overweight recent events, which is like driving while looking in the rear vision mirror. When we couple overweighting recent information with over-analysis of the past, we can begin to look for patterns that may not persist or have never been there in the first place. If we then apply them to the future to predict what might happen next, we can make poor decisions.

We need to replace predictive comments such as “markets are going up with markets have risen recently”. We should also heed Warren Buffet’s advice and “be fearful where others are greedy and greedy when others are fearful.”

Buffet and Richards are reminding us to:

– take care before switching your KiwiSaver fund to last year’s winning fund manager or portfolio,

– do your homework before buying a rental property as your brother in-law’s success will not guarantee yours,

– to remain invested or keep adding to your investment portfolio when markets are poor and the media is pessimistic.

I encourage readers to take time to plan and develop their investment strategy. Consider pros and cons. Turn off the financial media with its short-term focus and stick to your strategy despite the emotions you may be feeling.