Cambridge Partners constructs investment portfolios for your financial situation, preferences and objectives. We offer a range of model portfolios and socially responsible investment portfolios that suit different levels of risk and return objectives.

Our model portfolios

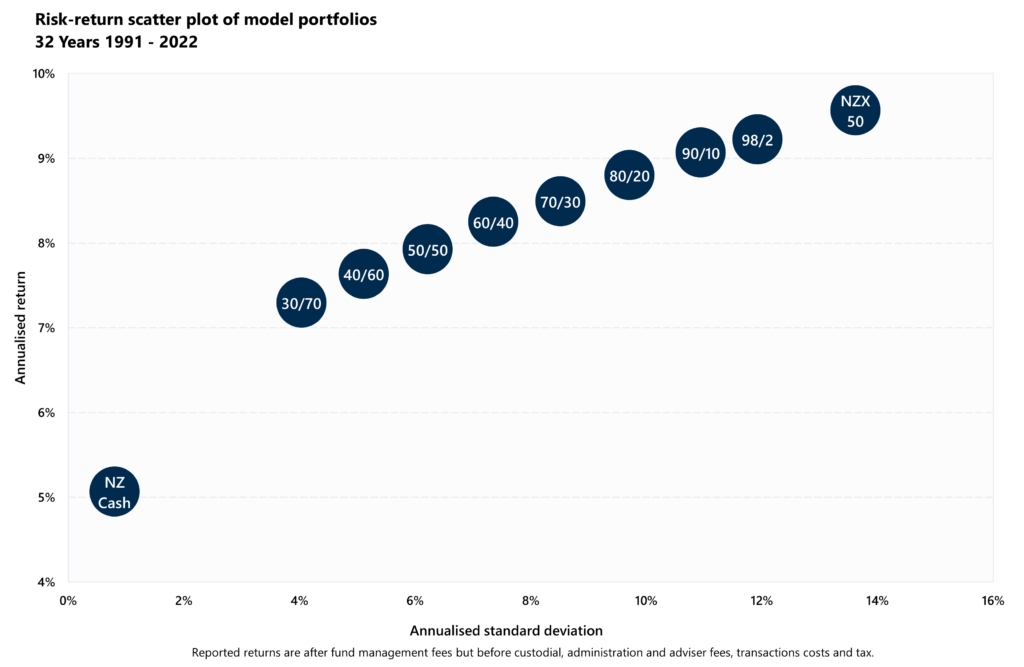

Each of our model portfolios suits different risk and return objectives with an overall target allocation to growth assets (eg shares) and income assets (eg fixed income). For example, our 60/40 portfolio will have a target allocation of 60% to growth assets and 40% to income assets.

Cambridge Partners will work with you to determine a strategy that best meets your needs and objectives.

Which type of investment strategy is suitable for you will depend on a range of different factors, including:

- Do you have the income and wealth to ride out short-term market movements?

- How much of your portfolio would you like to spend each year?

- Do you feel comfortable with the idea of losing portfolio value over the short term in order to grow more wealth in the long term?

- Do you have any specific investment preferences, such as the desire to hold certain assets or follow a socially responsible investment strategy?

Your circumstances, investment experience, risk and return objectives, and financial constraints change over time. We will meet with you on a regular basis to ensure that your portfolio continues to be the right fit for you and offers the highest probability of success.

A summary of each of our model portfolios is available from any of our Financial Advisers.

To learn more about how we approach Socially Responsible Investment, you can learn more here.

We look forward to finding out which of our investment portfolios suits your needs!